Deferred tax asset(DTA)和Deferred tax liabilities(DTL)的区别

Deferred tax liabilities(DTL):

Balance sheet item created when taxes payable<income tax expense,due to temporary differences.

递延所得税负债:

是资产负债表中的一个账户,它是利润表上的税费大于大于应付所得税所导致的暂时性差异。以下情况会导致递延所得税负债:

收入体现为应税收入之前已经计入了利润表中;

费用在记录到利润表之前已经作为税收抵扣项;

递延所得税负债预期可以转回,所以当支付相关税费时会导致现金的流出,常见的递延所得税负债是由不同的折旧方法导致应税收入和利润表上的收入不同形成的;

Deferred tax asset(DTA):

Balance sheet item created when taxes payable>income tax expense,due to temporary differences.

Calculate the difference between two bases

For assets=accounting base–tax base

For liabilities=(-accounting base)–(-tax base)

递延所得税资产(Deferred Tax Asset):

未来预计可以用来抵税的资产,是根据可抵扣暂时性差异及适用税率计算、影响(减少)未来期间应交所得税的金额。

递延所得税资产是利润表上的税费小于应付所得税所导致的暂时性差异。以下情况会导致递延所得税资产:

收入在记入利润表之前已经作为应税收入;

费用在作为税收可抵扣项时已经计入了利润表中;

税损结转可以作为未来收入的抵减项;

递延所得税资产和负债一样可以通过在未来的运营中转回,但所得税资产会给未来带来节税效益。

注意递延所得税资产和递延所得税负债是分别列在利润表中,不可以互相抵消。

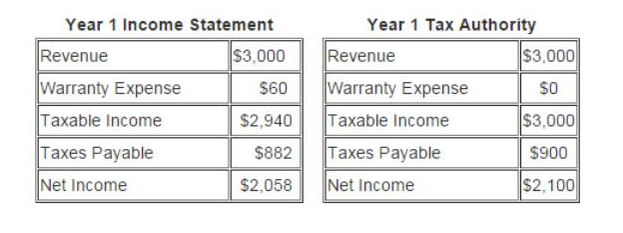

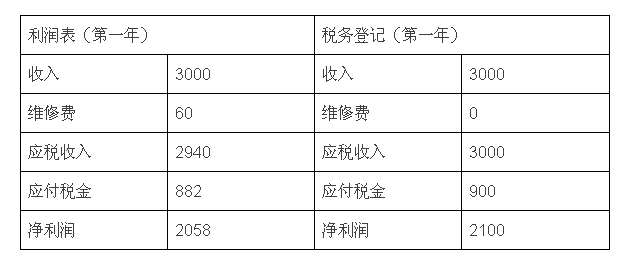

例1:a computer manufacturing company estimates based on previous lines of production that the probability a computer will be sent back for warranty repairs in the next year is 2%out of the total production.If the company's total revenue in year 1 is$3,000 and the warranty expense is$60(2%*$3,000)then the company's taxable income is$2,940.However most tax authorities do not allow companies to deduct expenses based on expected warranties,thus the company would actually require to pay taxes on the full$3,000.

If the tax rate for the company is 30%then:

The difference of$18($900-$882)between the taxes payable in the income statement and the taxes payable to the tax authority is considered the deferred tax asset.

一个制造笔记本电脑的公司基于以前的产品生产线,评估了售后维修的概率,即明年会发生总销售额的2%左右的修理费,如果公司在先进年总的收入是3000美金,保修费用就是3000*2%=60美金,所以公司的应税收入就是3000-60=2940美金,但与对于税务条款来说,不允许以预期的保修费用来作为收入的抵扣项,所以这个公司实际的交税基础为3000美金,如果目前的税率为30%的话,就会有(3000-2940)*30%=18美金的递延所得税的资产产生。

例2:Zimt AG presents its financial statements in accordance with US GAAP.In 2007,Zimt discloses a valuation allowance of$1,101 against total deferred tax assets of$19,201.In 2006,Zimt disclosed a valuation allowance of$1,325 against total deferred tax assets of$17,325.The change in the valuation allowance most likely indicates that Zimt's:

A.deferred tax liabilities were reduced in 2007.

B.expectations of future earning power has increased.

C.expectations of future earning power has decreased.

答案:B

【解析:】

B is correct.The valuation allowance is taken against deferred tax assets to represent uncertainty that future taxable income will be sufficient to fully utilize the assets.By decreasing the allowance,Zimt is signaling greater likelihood that future earnings will be offset by the deferred tax asset.

递延所得税资产对应的价值备抵账户,是对于未来是否可充分利用递延资产的不确定性来准备的,当备抵账户的金额下降时,表明公司预期未来的销售会增长,因此产生的收入会利用到递延所得税资产。

现在,只要花十秒钟免费申请获取精心研发的2017年CFA资料,免费索取CFA学习资料电子版,提升CFA备考效率和成绩. >>点我免费领取2017年cfa资料

现在,只要花十秒钟免费申请获取精心研发的2017年CFA资料,免费索取CFA学习资料电子版,提升CFA备考效率和成绩. >>点我免费领取2017年cfa资料

考试资讯

考试资讯

发布时间:2016-12-27

发布时间:2016-12-27

复制本文链接

复制本文链接 模拟题库

模拟题库

1540

1540