China’s move to deregulate its alternative asset management industry is paying off—both for fund managers courting the country’s wealthy potential clients and for investors seeking to diversify their holdings.

In the year since the opening of the industry, the Asset Management Association of China (AMAC) has registered about 3,563 private fund managers. Collectively, these managers run 5,232 funds

with assets totaling RMB1.98 trillion (US$322.3 billion).

Thousands more licensing applications are in the works,according to AMAC, which is the self-regulatory body established to oversee the alternative asset industry on the mainland.China’s liberalization of its asset management market enables it to breed one of the world’s most vibrant private fund management businesses, which could eventually account for a large chunk of the US$70 trillion global fund management industry.

Since the passage of the Securities Investment Fund Law in June 2013, more managers are opening their own securities trading accounts and running their own hedge fund platforms, abandoning the traditional structure of managing assets through government-backed trust funds.

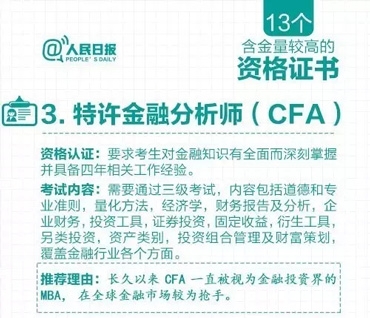

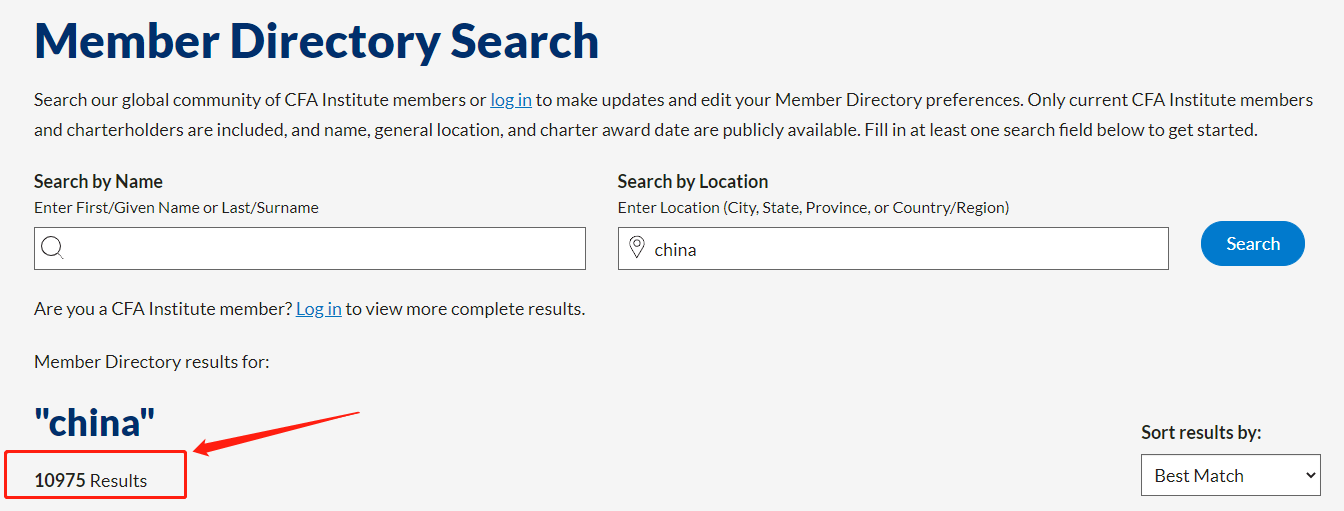

“The regulation is geared for Chinese local managers that want to do business locally or go overseas. The registration lends more credibility for these fund managers, especially when they do business with international investors,” says Joseph Zeng, CFA, partner at Greenwoods Asset Management,which manages more than US$4 billion in assets.Given the pace of wealth creation in China, the development was good news for the country’s high-net-worth investors and family offices. The lack of investment options has long been a challenge in the development of China’s capital

markets, with choices for Chinese investors limited to bank savings, stocks, bonds, and property. Regulated hedge funds will give these investors easier access to new products and instruments and a chance to further diversify their portfolios.In 2013, hedge funds in China achieved some of the best returns in the world, with the average hedge fund gaining more than 19%, according to research firm Eurekahedge.

This performance came in a year when the Shanghai stock market contracted nearly 7% in value and was among the worst-performing markets in the world. Even with such recent success among hedge funds, the reforms have a long way to go in transforming China into a major asset management hub. “There are still many uncertainties in the onshore management sector in China. We need much more clarification from the CSRC [China Securities Regulatory Commission] and the tax authority about what hedge funds are allowed to do,” says David Walter, the Singapore-based director of US-based fund-of-funds manager Pacific Alternative Asset Management Company (PAAMCO).

“The currency capital account [situation in China] isn’t helping,” adds Walter, who predicts the asset management business in China will evolve in tandem with the opening up of China’s broader capital markets.Global institutions and international fund managers,however, are keeping tabs on the developments in the industry. They see these funds as a potential way to gain access to more than 2,500 companies listed on the mainland.

Traditional hedge funds that run Chinese strategies outside China are sometimes limited to trading only 160 or so Chinese firms listed in Hong Kong, the United States,or the European Union.

STEPPING UP THE PACE (PDF)

Traditional hedge funds that run Chinese strategies outside China are sometimes limited to trading only 160 or so Chinese firms listed in Hong Kong, the United States,or the European Union.

STEPPING UP THE PACE (PDF)

协会动态

协会动态

发布时间:2013-11-10

发布时间:2013-11-10

复制本文链接

复制本文链接 模拟题库

模拟题库

26568

26568